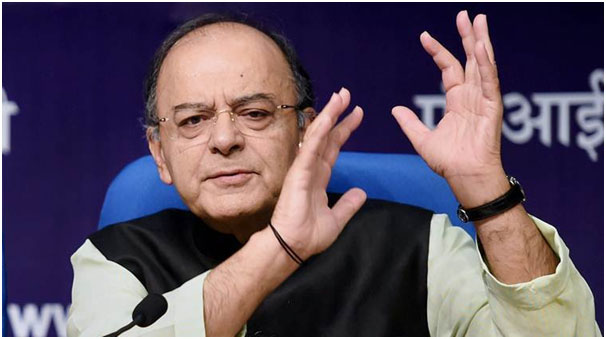

New Delhi: The GST Council on Sunday relaxed return filing rules for businesses for the first two months of the rollout of the new indirect tax regime. Briefing media at meeting of the council in New Delhi, Finance Minister ArunJaitley said, to obviate any lack of preparedness, a slight relaxation of time for two months has been given and from September, strict adherence to time will go on.

"The return for the month of July will have to be filed ordinarily by 10th of August even today there are 42 days to get ready before the return is filed. In any case to obviate any greivance or any lack of preparedness, a slight relaxation of time for the first two months that is return for the month of July and August was discussed and from September strict adherence to the time will go on and that those who are not ready after relaxation will have more than two to two half months to get ready," Jaitley said.

As per the revised return filing timeline decided by the Council, for July, the sale returns will have to be filed by September 5 instead of August 10. Companies will have to file sale invoice for August with the GST Network by September 20 instead of September 10 earlier.

Comments

needs a great deal more attention. I'll probably

be returning to read through more, thanks for the information!

RSS feed for comments to this post