New Delhi: Union Finance Minister ArunJaitley has said that the government is poised to take a call on including real estate in the Goods and Services Tax regime.

The GST Council is set to take up the topic of bringing real estate services under GST's ambit next month, Jaitley said. He went on to acknowledged that real estate is one sector with highest amount of tax evasion and cash generation occurs.

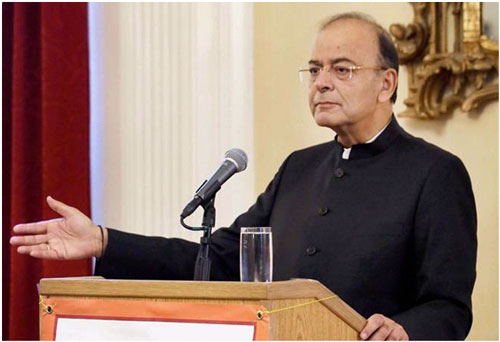

Delivering the 'Annual Mahindra Lecture' on India's tax reforms at the prestigious Harvard University, Jaitley said that the matter will be discussed when the GST Council meets for its next meeting scheduled on November 9 in Guwahati.

"The one sector in India where maximum amount of tax evasion and cash generation takes place is real estate and which is still outside the GST. Some of the states have been pressing for it. I personally believe that there is a strong case to bring real estate into the GST," Jaitley said.

The Indian real estate market is expected to touch $180 billion by 2020. The housing sector alone contributes 5-6 per cent to the country's Gross Domestic Product (GDP), according to India Brand Equity Foundation, a Trust established by the Department of Commerce, Ministry of Commerce and Industry.

"In the next meeting itself, we are addressing one of the problem areas or at least having discussion on it. Some states want, some do not. There are two views. Therefore, by discussion, we would try to reach one view," he said.

Bringing real estate under the ambit of GST would result in consumers paying one "final tax" on the whole product, which would be help them by making the taxes almost negligible, Jaitley said. As of now, a 12 per cent GST is charged on construction of a complex, building, civil structure or intended for sale to a buyer, either wholly or partly. On the other hand, land and other immovable property have been kept free from the GST.

On demonetisation, Jaitley said it was a "fundamental reform" which was necessary to transform India into a more tax-compliant society. Jaitley said some people had "misunderstood" the objective of demonetisation "which wasn't to confiscate somebody's currency".